Hosted By

About Social Pros Podcast:

Social Pros is one of the longest-running marketing podcasts in existence (10 YEARS and counting), and was recently recognized as the #1 Audio/Podcast Series by the Content Marketing Awards.

Our purpose? Making sure that we speak to real people doing real work in social media.

Listeners get inside stories and behind-the-scenes secrets about how teams at companies like Google, Reddit, Glossier, Zillow, Lyft, Marvel, and dozens more, staff, operate, and measure their social media programs. With 600+ episodes, the Social Pros Podcast brings the humanity of social media to the forefront, while providing incredibly useful marketing strategies that listeners can immediately implement.

Follow Social Pros on LinkedIn.

To inquire about becoming a guest or show sponsor, please email our Executive Producer, Leanna Pham, at leanna@convinceandconvert.com.

Apple Podcast Reviews:

The Social Pros podcast has quickly become a favorite in my feed! I'm consistently impressed by the engaging conversations, insightful content, and actionable ideas. I truly learn something every time I listen!

@Arlie KThis is absolutely an awesome listen for anyone in communications or social media!!

@Will31CThis podcast has become one of my staple weekly podcasts for learning about marketing! Love the conversations that they have and it's always enjoyable and educational!

@Simonstone95Love the podcast - informative, in depth and spot on for any business size.

@MissTriathlon

This is Episode 31 of the Social Pros Podcast : Real People Doing Real Work in Social Media. This episode features Howard Lindzon, CEO of StockTwits. Read on for insights from Howard about investing, forming relationships, and building a successful community. Listen Now Click the play button to listen here: [podcast]http://socialpros.podbean.com/mf/web/gmwnkd/SocialProsEpisode31.mp3[/podcast] Download the audio file: http://socialpros.podbean.com/mf/web/gmwnkd/SocialProsEpisode31.mp3 The […]

This is Episode 31 of the Social Pros Podcast : Real People Doing Real Work in Social Media. This episode features Howard Lindzon, CEO of StockTwits. Read on for insights from Howard about investing, forming relationships, and building a successful community.

This is Episode 31 of the Social Pros Podcast : Real People Doing Real Work in Social Media. This episode features Howard Lindzon, CEO of StockTwits. Read on for insights from Howard about investing, forming relationships, and building a successful community.

Listen Now

Click the play button to listen here:

[podcast]http://socialpros.podbean.com/mf/web/gmwnkd/SocialProsEpisode31.mp3[/podcast]

Download the audio file:

http://socialpros.podbean.com/mf/web/gmwnkd/SocialProsEpisode31.mp3

The RSS feed is: http://feeds.feedburner.com/socialprospodcast

Find us on iTunes: http://itunes.apple.com/us/podcast/convince-convert-blog-social/id499844469

Please Support Our Sponsors

Huge thanks to data-driven social media management software company Argyle Social for their presenting sponsorship, as well as Infusionsoft, Janrain, and Jim Kukral at DigitalBookLaunch. We use Argyle Social for our social engagement; we use Infusionsoft for our email; Janrain is our crackerjack social integration company, and Jim is our guest host for the podcast (and a smart guy).

Social Pros Transcript For Your Reading Enjoyment, Thanks to Speechpad for the Transcription

![]()

Eric: Good afternoon. Good evening or good morning, folks. Welcome to Social Pros number 31. My name is Eric Boggs. Our fearless leader, Jay Baer, is on an airplane somewhere, so I’m taking the reins today. With me on the line is our trusty sidekick, Jim Kukral from Digital Book Launch. How’s it going, Jim?

Jim: I’m doing great! How are you doing, Eric?

Eric: Doing just fine, doing just fine. Before we get into the show, we’re going to thank our sponsors, which include Jim’s company, DigitalBookLaunch.com, Infusionsoft, makers of email marketing software for small and medium-sized businesses, Janrain, fine purveyors of social sign-on technology, and my company, Argyle Social, makers of social media management software.

We have a great guest today, and because Jay is on a plane, and because I’m lazy, we’re going to break the format and just skip right ahead to the guest. Is that okay with you, Jim?

Jim: Hey, it’s your world, boss. I’m just living in it.

Eric: All right. So Howard Lindzon is with us today. Howard is the CEO at StockTwits. He is an early stage investor in quite a few social media, software, and technology companies, companies that you’ve heard of like Bitly, TweetDeck, Buddy Media, and he’s also a really funny guy. So, Howard, thank you very much for joining us on the show today.

Special Guest – Howard Lindzon, StockTwits

Howard: Hey, guys. I am pretty hysterical.

Eric: Occasionally, right?

Jim: It’s a lot to live up to. Now be funny, Howard. Go.

Eric: So, Howard, I definitely want to spend most of our time together talking about StockTwits, but I want to start off talking about Wallstrip, which is a project you did several years ago that I thought was absolutely fantastic. For those of you that aren’t familiar, Wallstrip was kind of an online video show about stocks and trading and companies. How did that concept kind of come to be, Howard?

Howard: Two things: I invested in this golf company that was going super well, called GolfNow and we were doing all the transactions. So, we had the hard part of the business. We were printing money. It was ’05, ’06, beginning of the social web and I was like, “Guys, we should create this show now and keep people engaged. We’ve got them giving us their credit cards. We could lock down the whole golf experience.”

Eric: Yeah.

Howard: They were like, “You’re crazy. Why would we spend money on…? We’re making money. Why would we invest money in content and community?” So, I kind of had a pickle up my ass and at the same time I also hated CNBC. At least I wasn’t watching it any more. I just didn’t feel it was useful. Twitter, I don’t think was quite yet around, but the whole social around discuss and everything, and commenting platforms and blogs.

So, I created a three-minute, very positive show idea around one stock a day, search engine optimized. Pitched it to Fred Wilson, he said, “For sure. Let’s do it,” and he introduced me to a bunch of friends and we were off and running.

Eric: How long did the show run?

Howard: Two years, about 400 and something episodes.

Eric: Oh, my God. That’s a lot of content.

Howard: A lot of content, very tough business. I don’t know. I respect that you’re trying to make content. I do it still. I think one of the reasons I like short, micro-blogging stuff is it’s just kind of a way for me to journal and goof around. It’s kind of like a live, social chat.

Eric: Yep.

Howard: So, it always kind of made sense to me.

Eric: Yeah. Sure. You were often the star of the show in StockTwits.

Howard: I was occasionally cameoing. So, I wrote it and produced it and created it. But Lindsay was the star and occasionally we’d work me in as the goofball stock guy.

That’s what worked, I think, really well. Kind of like Larry David, inspired by Larry David, David Letterman, Jon Stewart.

Eric: Yeah. Well, it’s definitely internet legend, really good stuff. If listeners have not heard of Wallstrip, I highly recommend tracking down – I think episode 1 was the Apple episode, where they had launched the retail stores. I thought that was a really, really funny episode. So, now you’re running StockTwits?

Howard: Yes.

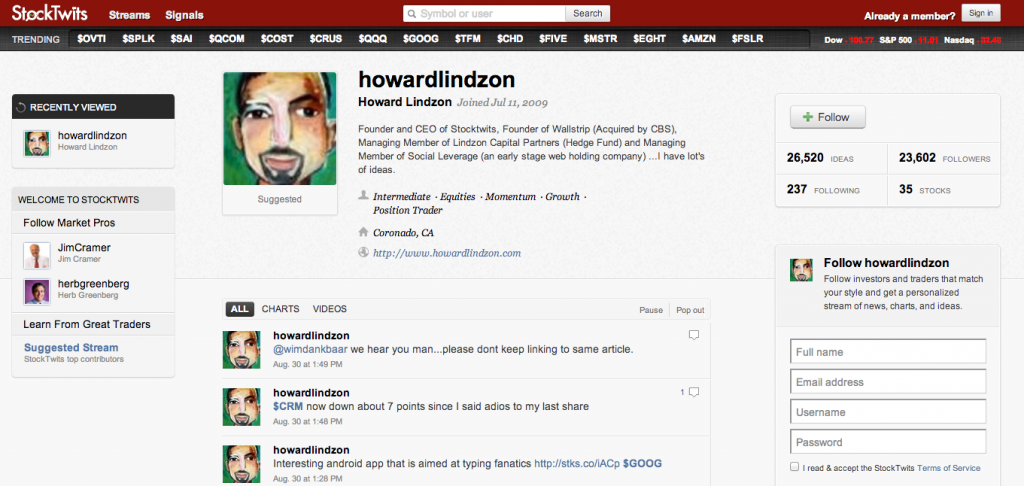

Eric: The backstory on StockTwits, how did this company kind of find its legs?

Howard: Really similar kind of background, I did not want to start another company. I was using Twitter, didn’t really get it, was goofing around a lot, and mobile hadn’t really blown up yet. But I loved stocks and I felt like, man, chat rooms and message boards had always done so well in the finance world. I thought a Twitter for stocks would do really well. So, I wrote about it in June 2007 and I said, “Whoever wants to start this with me can,” and I got a lot of feedback and I just started it.

Eric: Did you fork StockTwits off of the primary Twitter platform? Wasn’t there something like that where you were kind of like somehow intermingling the two technologies and then sort of developed your own platform after the fact?

Howard: Yeah. So, at the beginning, it seemed like a simple idea to just kind of help Twitter and use their network and build on top of Twitter. But it became quite apparent that if we’re going to build a business we couldn’t rely on Twitter. So we went, kind of raised some money then, a little more money, in the end of ’08, and in March ’09 launched our own platform. So, now we’ve been our own platform for three and a half years.

Eric: Awesome, awesome.

Howard: So it wasn’t so much we trusted or didn’t trust. There was just no way you could build a business on top of Twitter.

Eric: Yeah, certainly, certainly.

Howard: We were thinking that way back in late ’08, early ’09.

Eric: Because you are a much smaller, standalone network, that changes the culture of your community, right? I mean, all of your users are kind of rabidly passionate about the same thing. How does that affect the way you grow your user base and activate the users inside of the technology?

Howard: One more time on that question?

Eric: Well I mean, everybody that uses StockTwits is a stock trader of some either of some philosophy or some level of expertise, right?

Howard: Yeah.

Eric: How do you, one, find more users, and two, how do you kind of perpetuate activity inside of the user base?

Howard: Great question, so that’s been the dilemma, right? We’ve been as conservative as we can about spending money because we haven’t figured out – I don’t even think Twitter, personally, has figured it out around promoted tweets. I think that’s a nice business but I don’t know if it’s “the” business. So, we’ve dabbled in many ideas around how to monetize. But people, consumers or retail investors, paying for data and stocks is just not a – it’s a tough one.

So, we’re not aggressively bringing on new people. We’re a curated, kind of private network in a sense, so it’s like, not everybody’s welcome and there are certain rules. So, it hasn’t been about, “Let’s get to ten.” Twitter’s mandate is users.

StockTwits’ mandate is behavior and ideas, and good ideas and good people.

Eric: Yep.

Howard: And no open API, so immediately we’re hamstrung in terms of users. But right now we’re just about 40,000 crazy monthly actives that are highly engaged, so I don’t know how much bigger it needs to be. It works in the sense that I have a highly engaged community that I interact with and we share ideas all day. We help people build their brand. But, yeah, I mean, there’s going to be a lot of decreasing benefit, where if there were 1 million people using it, it may just be too complicated.

Howard: And no open API, so immediately we’re hamstrung in terms of users. But right now we’re just about 40,000 crazy monthly actives that are highly engaged, so I don’t know how much bigger it needs to be. It works in the sense that I have a highly engaged community that I interact with and we share ideas all day. We help people build their brand. But, yeah, I mean, there’s going to be a lot of decreasing benefit, where if there were 1 million people using it, it may just be too complicated.

Eric: Yeah.

Howard: But I think we could get to easily 200,000, 300,000 people. Bloomberg has a couple hundred thousand people, so I think we could get somewhere between 200,000, 300,000 people in the next year or two. We’re experimenting with growing more organically and virally and opening up our API slowly here in the rest of the year. But right now it’s mainly just been word of mouth, press, hustle, some natural search. Early on we did some marketing on CNBC, but the audience itself is just not that big.

Eric: Yeah. I guess that’s kind of the good thing, is you know exactly where these people are and it’s not like you’re trying to boil the ocean. You have a very refined target of who you want to use your product.

Howard: Yeah.

Jim: Hey, I have a question. Howard, I’m a financial idiot. I don’t know anything about stocks. I don’t do any of that stuff, but I get what you’re doing here. The question is, you said you help people build their brands, what did you mean by that?

Howard: Well, like any social media, 90% of these guys that have small businesses, where they’re managing other people’s money, there are reasons you share – ego, mentoring, journaling… Well, maybe three. There’s probably a fourth in there. But people share to YouTube for the same reason they share to StockTwits, to build a brand around their name and show that they’re good at what they do, and they’re proud of it.

Second is a lot of people just want to journal, which is what I allot it for, is just a way for me to go back and forth and see what I was thinking.

Eric: Yeah.

Howard: It keeps me honest. Then the third is mentoring. A lot of people just like, if you’re in a lone room by yourself trading all day. It’s pretty easy to share and mentor.

So, StockTwits is just a social layer. It’s its own platform and it’s its own network. But we also just provide a message box that allows people, if Twitter’s the place they really want to share the most and they have the biggest audience, they can push their messaging there. So, by that I mean they can build their brand. They can use StockTwits as a place to amplify all their messaging.

Jim: So, how do you keep out – obviously, whenever you create any type of free service, which I’ve had businesses that do that and they give people… One of the greatest things about social media and the worst things about social media is that everybody who doesn’t understand it thinks that it’s their opportunity to come in and start promoting their crap over and over, and over again.

I imagine you have people who have vested interest in certain companies and their businesses, who just want to come in and start spamming with, “Hey, this is the stock everyone should be looking at,” and, “Check out my trading association.” How do you deal with all that? Do you filter it out or is it just part of the stream?

Howard: Yeah, those are the good questions. So it’s never a perfect science. We use technology, we use community, and we use algorithms and we use our own eyes, humans, our own people that work at StockTwits. So, you’ve got to defeat their soul. You’ve got to defeat their heart. With Twitter it’s impossible because they have an open API and people can just spam away, machines, etc. StockTwits doesn’t have that.

We’ve been pretty careful from day one about defining the house rules. It’s not perfect. It’s cost us. At the risk of us kicking out the next great stock person or Cramer or whoever you want to call that person, that’s the risk StockTwits takes because we kick so many people off. Our belief is that if you want to just go swear and spam you can just use Twitter. Well, they’re the Nile River of it all, right?

Eric: Yeah.

Howard: Yeah. We think swearing is good if it’s hilarious and used appropriately.

Eric: Sure.

Howard: So no penny stocks, which probably gets rid of 90% of the spam. The other 10% you curate by just kicking them off. If a tree falls in the woods and nobody hears it, did it really fall? If you have no followers and you come onto the site blasting away and nobody hears you and we see it, then we can delete stuff. But really we just have a reputation for being a place where you can’t get away with shit.

Eric: Yeah, I mean, it seems like there would just be a lot of social normalization that keeps people in line.

Howard: Yeah. It’s amazing what you can do after two or three years if you have a reputation for saying, “Guys, you can’t come on StockTwits to spam. No one’s going to like you. They’re going to kick you off,” so they don’t show up anyway.

Eric: Yeah. So our listeners are generally community managers for large brands and small businesses and of the like and one of the reasons we were so eager to have you on the show is that, as the CEO of StockTwits, you are a community manager.

Howard: Yes.

Eric: You have your community of users that that is your core asset, really.

Howard: At the sake of us being a small business one day, and I’m not ashamed of that because I’ve had many big businesses, is we’ve taken VC money so we have a responsibility to try and build a big business.

Eric: Sure.

Howard: But we’re a community.

Eric: Yeah.

Howard: We’re not ashamed of saying, “Well, if the community’s 40,000 and that’s as big as it can be, how do we turn that into a big business?” How do we turn these voices, how do we turn this data or this signal from these 40,000 people into a product that the masses would like without destroying the community? How do you make people feel like “Cheers”? “Cheers” was one of my favorite shows growing up and people would walk into the bar and everyone would go, “Hey, Norm!”

Howard: We’re not ashamed of saying, “Well, if the community’s 40,000 and that’s as big as it can be, how do we turn that into a big business?” How do we turn these voices, how do we turn this data or this signal from these 40,000 people into a product that the masses would like without destroying the community? How do you make people feel like “Cheers”? “Cheers” was one of my favorite shows growing up and people would walk into the bar and everyone would go, “Hey, Norm!”

Eric: Yeah.

Howard: I try and do that with StockTwits. If you take the time to set up an account and ask me questions there or put a photo up and behave, I’m pretty much there within half an hour to answer any questions people have.

Eric: Sure.

Howard: So, I think community to me means a couple simple things. You have to show up. You have to want to do it, or else you’re just never going to have a community. Then, the other thing about community is I don’t think you can just magically create one. I think it’s just from Wallstrip to all my other investments, to my writing, to the goofing around on the web, people know us and they trust us. That’s what StockTwits really stands for the most is a place you can kind of come into even if you think you’re a stock idiot. I think the institutions have proven that there are no stock idiots. They are just idiots.

I think everybody can invest and make money and do it happily. I think everybody’s style is different and I think that’s what StockTwits is. We’re like, kind of the mutts of investing. There’s somebody for everybody here to either mentor. I think as a journal it’s a phenomenal product but as a community, number one most important thing is that we love stocks and we love markets.

Eric: Yeah.

Howard: I think everybody that shows up knows that 24/7, we’re the goofballs that just love talking about that. So, that’s the number one asset we’re trying to protect all the time with customer support and service and answers. I think you’re listeners are building community. I don’t think it’s so simple to say, “Oh, I set up a Twitter/Facebook account. Now magic will happen.”

I think it takes years and years.

I think people see through the pictures and how you set up the account and how responsive you are. There are no social media experts and there’s no journal for how to do this.

I tell people, I’ll tell your listeners too, it’s like a bank. It’s just a very inflationary environment like Latin America in the ’90’s. You have this bank, which is social media, and you’d better start making deposits and stop trying to measure day one what you’re getting back, because you’re not going to get anything back.

If you make a deposit of $1 and try to take out $10, you can’t do it.

![]() So you can do that in social media. There’s no $9 to take out until you put in $1,000.

So you can do that in social media. There’s no $9 to take out until you put in $1,000.

Eric: Yeah.

Howard: So I think that’s the big mystery when I see people call themselves “social media experts”. I go, “Really, this is about deposits,” and Americans pretty much have proven in the banking industry that we suck at making deposits. We’re really good at leveraging ourselves.

So, I think why we’re seeing this kind of meltdown is that people are tired. People don’t understand that you can’t just sign up and just magic will happen. You have to make tons and tons of deposits and you have to be very careful what you ask for. You have to want to do it. Does that help?

Eric: Yeah. No, you’re right on point. So there’s definitely kind of the very person-intensive, relationship-intensive methodology for building a community that takes time, which is what you just described. Do you guys use any sort of technology or insights based on your user actions, user influence to map your community, to understand kind of who the movers and shakers are, to kind of federate that community building amongst your users?

Howard: Yeah. It’s hard though. I think, like community, trying to force any one prong of it – well, it’s very tough. We’ve failed at that in the sense that I think that’s the stressful part of building a community. I don’t think you know where the true leadership is going to come from. You have to kind of tap everybody. We have our own graph and it’s small because stock people don’t need to follow as many people as someone maybe on Twitter or Facebook does with friends. You can follow probably 30 people and just have the greatest financial feed of all time using StockTwits. So, it’s not like you need to follow 200 people.

Yes, we’ve thought about it. Yes, we have our own clout scoring system internally. We don’t use Klout, but we know who everybody is and we know who’s good and who’s bad. But I don’t know if we feel like that’s necessary to share that.

Eric: Sure.

Howard: But it’s something we think about all the time. We added a born on date for people so at least people could come by your profile and see how long you’ve been there. But we’ve got to do more. I would argue that every vertical is different.

I think community is the future and I think we’re headed to a world of verticalization. My investments have moved much more narrow to micro-communities and micro-investing in the sense that I’m looking at smaller ideas around real curators and experts and passionate people around subjects.

Eric: Yeah. That’s actually my next question smaller vertical platforms. I remember the talk you gave at Big Boulder, where we met briefly. You mentioned making some investments in kind of, I guess, StockTwits for comedy type of companies. Can you talk a little bit about those?

Howard: Yeah. I’ve made two small investments – Laffster, which is more of a Pandora, a really interesting company, young guys out of L.A.; and WitStream, which is a woman in New York, Lisa Cohen, who’s super funny and talented around comedy curation. So, she created a 24/7 live ticker around curating tweets of comedians and with trending topics. I think that it’s just comedians do the news funnier than anybody.

So, I just think that one made common sense, but we haven’t figured out much, other than we’re organizing it, and it’s a really cool app. The way I look at Laffster is when I go to bed, I want to open my laptop or iPad and just kind of go through some of the funny clips from shows that I like of the day, something that I can lean back and kind of just thumb up, thumb down, and just get caught up on clips that will make me laugh as I go to bed.

Eric: Sure.

Howard: I think for other people it would be different things. So, I think comedy and sports are two huge verticals that Twitter and Facebook and LinkedIn kind of own the breadth of the social graph. I don’t think it’s smart to try and recreate those. I think what’s smart is to try and fine tune those.

Eric: Yeah. What is it that makes the vertical platform so compelling in your mind? Is it the strength of the community and the depth of the subject matter? Or is it just the fact that it’s smaller and it’s easier to know everybody that’s sitting around the bar?

Howard: I would say it’s less competitive because the VCs aren’t there.

I think there’s tons of exit strategy. I think as Google Plus and Facebook struggle to properly monetize this, meaning they’re monetizing with ads instead of technology and features that people will pay for, I think the people that do verticals right are in a good position to get not acqui- hired, but actually acquired for their knowledge.

I just think it’s a space that if you invest properly, there’s going to be tons and tons of consolidation…

Eric: Yeah. That makes sense.

Howard: …by the media guys. So, I’m not looking to invest in billion dollar companies. I passed on Twitter early and Zynga and Facebook, so I wouldn’t even know a billion dollar company if they hit me in the face. No, I mean I really passed. I was like, “What? Those are dumb.”

Eric: Yeah, “That will never work.”

Howard: Not that it’ll never work. I honestly don’t question that. I just question, “So I put in $50,000. I’m going to get diluted. It’s going to need way more money.” Sometimes you’ve got to say “no” to stuff that just financially doesn’t make sense to you.

Eric: Yeah.

Jim: So I’ve got a question for you, Howard, because I’m an entrepreneur, a small business owner and that’s who my customer is and audience is. I know that there are people listening to this and they have the next big idea. You’re a guy who invests money sometimes in these things. How do these people pitch you? I mean, how do you decide to make investments? I know you probably get pitched constantly. What are the ways not to pitch you and what are you actually looking for?

Howard: So, the good question there is what not to do. Okay, so if you were going to invest tomorrow and I was your mentor, I’d say, “Okay, let’s start by making this easier. If someone gives you a tip, they’re not your friend.” I would say, “Open a Schwab account and cut your costs.” So, I’ve already just made two easy decisions for you. Then the third decision would be, “Okay. Never buy an airline, a component stock,” so I’d be narrowing it down at least for you, right?

Jim: Yeah.

Eric: Yep.

Howard: So how not to pitch me is, you can’t just go around pitching people that you don’t know.

Everybody thinks their idea is great. The tools are there for people that have written a business plan or have a deck that they want to share. To find the investors that that idea may at least resonate with, so it’s just – context matters. I don’t invest in certain things. So, if you spent two minutes on my site or a week on my blog, you kind of know what interests me.

I call it foreplay. I think enough young investors don’t understand the idea of foreplay just like most community or brands don’t understand the idea of social media is you have to drip. You can’t just ask.

Eric: Yeah.

Howard: So I think men suck at foreplay. But if you’re looking to get your business started, you’d better start faking it and being nice both to your family and your parents, and to investors. By that I mean, hanging out in their comments section, not asking them for stuff, being part of the community. It takes time, right? Or you could just send a blind email to 50 people and be resentful that none of them sent an email back to you.

Jim: That’s work, Howard.

Howard: Yeah. So, I guess the short answer is you’d better be ready to work because your idea is just as good as the other thousands of entrepreneurs sitting in a Starbucks with their Mac Air, banging out business plans. So, I don’t have an easy answer for you except that foreplay, you have to tickle investors.

Howard: Yeah. So, I guess the short answer is you’d better be ready to work because your idea is just as good as the other thousands of entrepreneurs sitting in a Starbucks with their Mac Air, banging out business plans. So, I don’t have an easy answer for you except that foreplay, you have to tickle investors.

Jim: But isn’t that the crux of social media as it stands now? Like I mentioned briefly earlier, everyone seems to think that since I now have this ability to broadcast, I could get everything I want. I could just put my business plan on a Bitly link and tweet it to you and you’re going to give me $1 million.

Howard: Yeah, but I’ve got to open it. I have to open it. If you do all that and then what’s the sexy pitch that gets me to open it?

Eric: Right, exactly.

Howard: So I already have all these plans coming to me from people that are in my social network or are entrepreneurs that I’ve actually done business with their friends of friends. So the first thing I would say is use that network that you’ve created and if you haven’t started a network, you’d better start one and you’d better understand, like I said, be nice to your parents and be nice to investors.

If that means faking it, there’s nothing wrong with faking it until you make it. But you’ve got to start making those deposits today. What you’re saying is exactly right. It’s never been easier to start these things at least. But that’s to your advantage. It’s never been easier to at least start this.

Jim: Yep.

Eric: I’ll echo Howard’s sentiment, Jim. When Argyle raised our seed financing almost two years ago, we had six investors. Five of the six, I had known at least a year before I asked them for a nickel, either through my school network or just through the community. So, it is a lot of making your friends before you need it kind of thing, just like Howard described.

We’re coming up on our half hour so, Howard, thanks for joining us, man. But before we close, we generally like to ask our guests to give a Social Pros shout out to someone in your community that maybe doesn’t get the recognition that they deserve that’s doing some interesting work around social media or community building. Anybody come to mind? I know you mentioned some of the investments that you’ve made in Laffster and WitStream.

Social Pros Shoutout

Howard: Yeah. Well, everybody’s hardworking. I’ve invested in over 50 start-ups. But I think on StockTwits, I think the unsung heroes are the people that share all day and guys like, you wouldn’t know him, but Daytrend and Greg Harmon. These are people that just – I think they’re doing it for themselves. Everybody does stuff for themselves, but they’re just constantly sharing and they realize that by sharing, they’re making themselves smarter.

Eric: Yeah.

Howard: My son, the more you write it down the more you remember. With social media, writing shit down and then just pushing a button amplifies your knowledge and sharing with thousands of other people. So, I think we’re in a really interesting time. People are really mad right now, but I don’t think they really understand the true power and the leverage being created out there.

Eric: Yep, agreed very much, Howard. Thanks again for joining us. That’s going to do it for Social Pros number 31. On behalf of Howard Lindzon of StockTwits and Jim Kukral of Digital Book Launch and also our additional sponsors, Janrain, Infusionsoft and Argyle. My name is Eric Boggs. We’ll be back with episode number 32 next week. Thanks for listening.